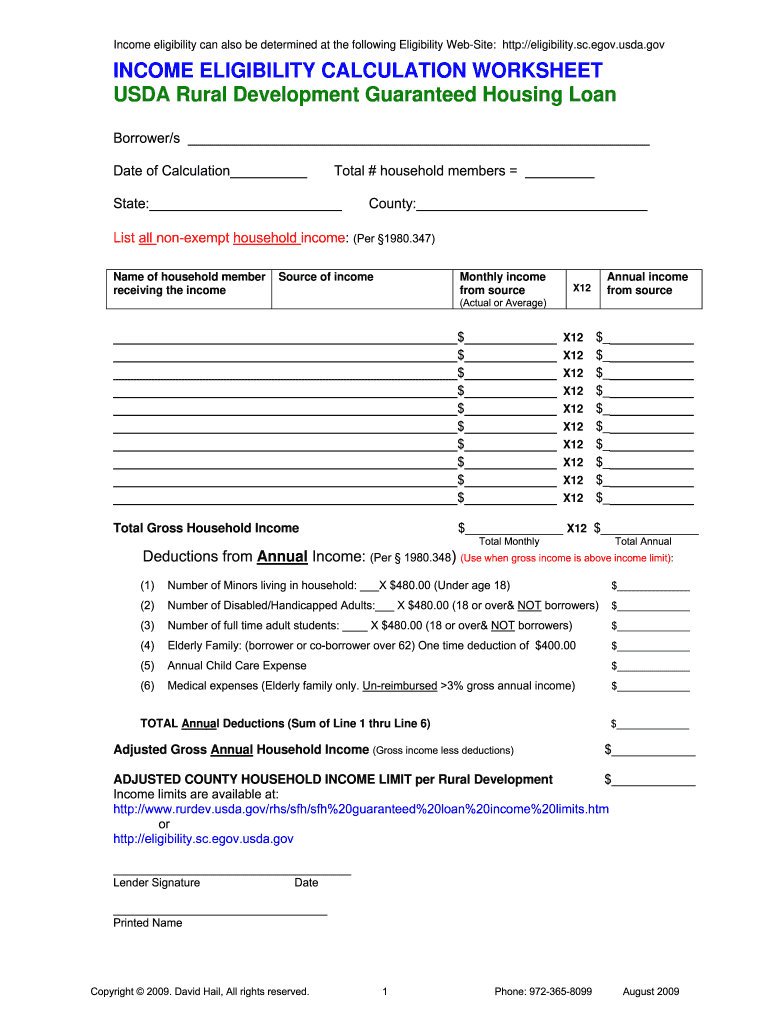

Get the free usda income calculation worksheet form

Get, Create, Make and Sign

Editing usda income calculation worksheet online

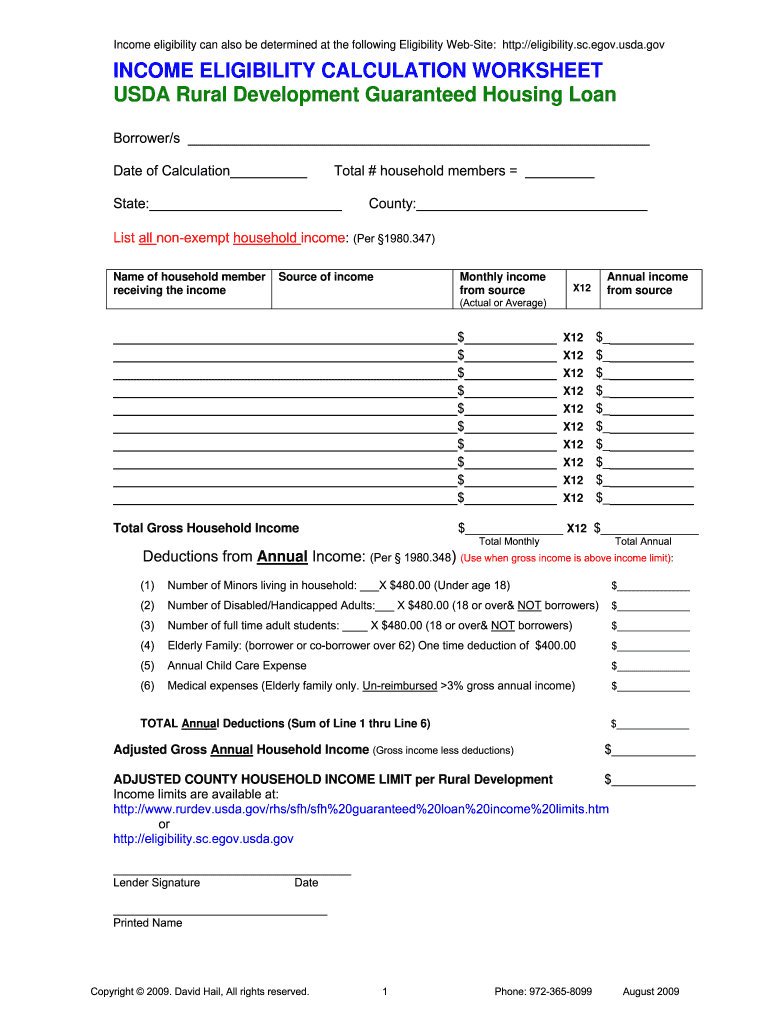

How to fill out usda income calculation worksheet

How to fill out the USDA income calculation worksheet:

Who needs the USDA income calculation worksheet?

Video instructions and help with filling out and completing usda income calculation worksheet

Instructions and Help about fillable usda income worksheet form

Hi and welcome to loan officer school this is your how to calculate income training session once again I'm Sherman Lane please call me Star because the toilet paper jokes got old by the third grade and done you can always reach me at Charmin out loan officer school comm, and you can call our offices at eight six six six two three one two five zero once again visit our website at loan officer school comm we've got lots of programs and products and audios and be is that it can help you be a better loan officer alright income most primary types of income that you're gonna ever have to calculate are those off of w-2s pay stubs tax returns and a few extra things that you need to look at when it comes to self-employed borrowers now step number one is looking at a borrower's w-2 a bunch of numbers on it but what are you really looking for well you're going to need two years of w-2s so make sure that you're always requesting at least a minimum of two years you're also going to be looking at box five for Medicare wages and tips because this is how much a bar were actually earned but what they paid in one of their other boxes is what they were taxed on remember if you're contributing to some type of it IRA or a 401k that is done pre-tax dollars you made this money, but you may not have paid taxes on it because you put it into some secured account, so that's why you're going to be looking at your Medicare wages and tips box number five what you're going to do is look at both years of your box five for the last two years of w-2s you're going to add them together, and then you're going to divide by 24 months to come up with the average this is going to be your monthly qualifying income now sometimes lenders are a little generous, and they'll let you qualify just off of what the borrower's current salary is but if you got Commission bonuses and anything else at your regular over time you're going to have to use the average for those amounts because sometimes the dollar amounts can be inconsistent, so you want to make sure that the borrowers are using the average amounts if it's some type of again commissions over time bonuses things of that nature, so this is what some w-2s look like now depending on who your provider is your payroll provider is they are all going to look a little different so what you want to do is just find box five it's going to be located somewhere differently on every type of w-2, but you're gonna look at some general information so right here we've gone to barber who made forty-two thousand seven hundred and twenty-four dollars that year and this is in the year 2003 this is just a sample exam our sample example here so don't worry about that at their years two thousand three and four this is just a made-up w2 all right, and then you've got another year of 2002 of fifty-one thousand one hundred fifty-eight dollars and fifty-nine cents so what we're going to do is add those two years together or those two amounts together sorry about that...

Fill form : Try Risk Free

People Also Ask about usda income calculation worksheet

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your usda income calculation worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.