Get the free usda income calculation worksheet

Show details

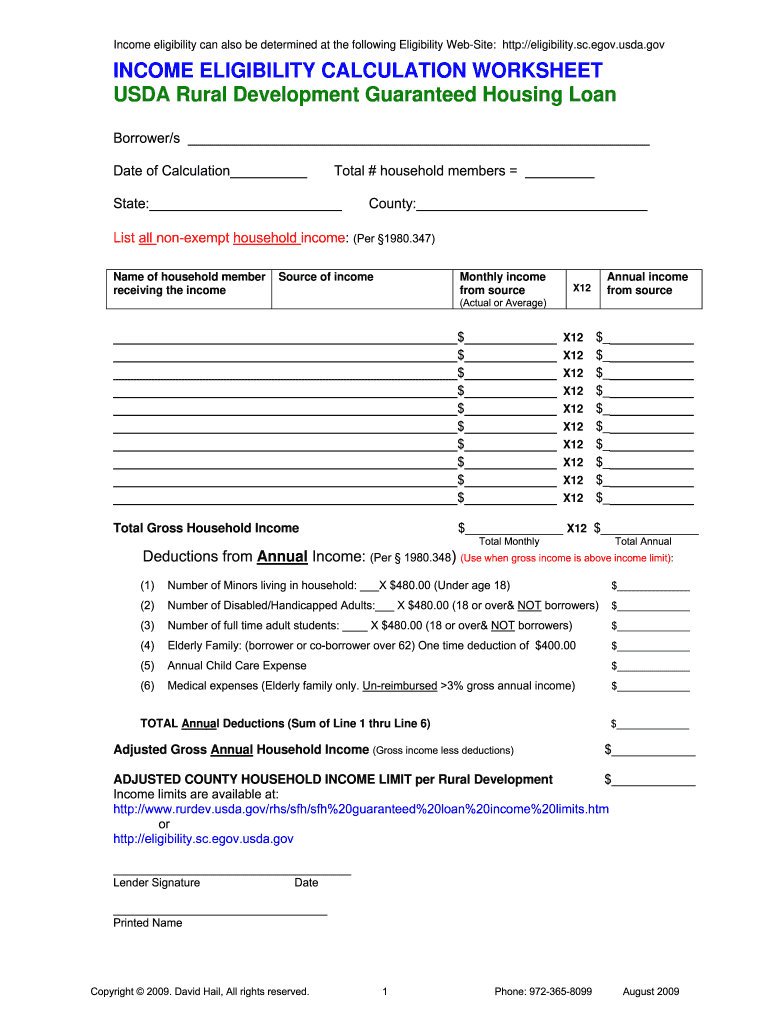

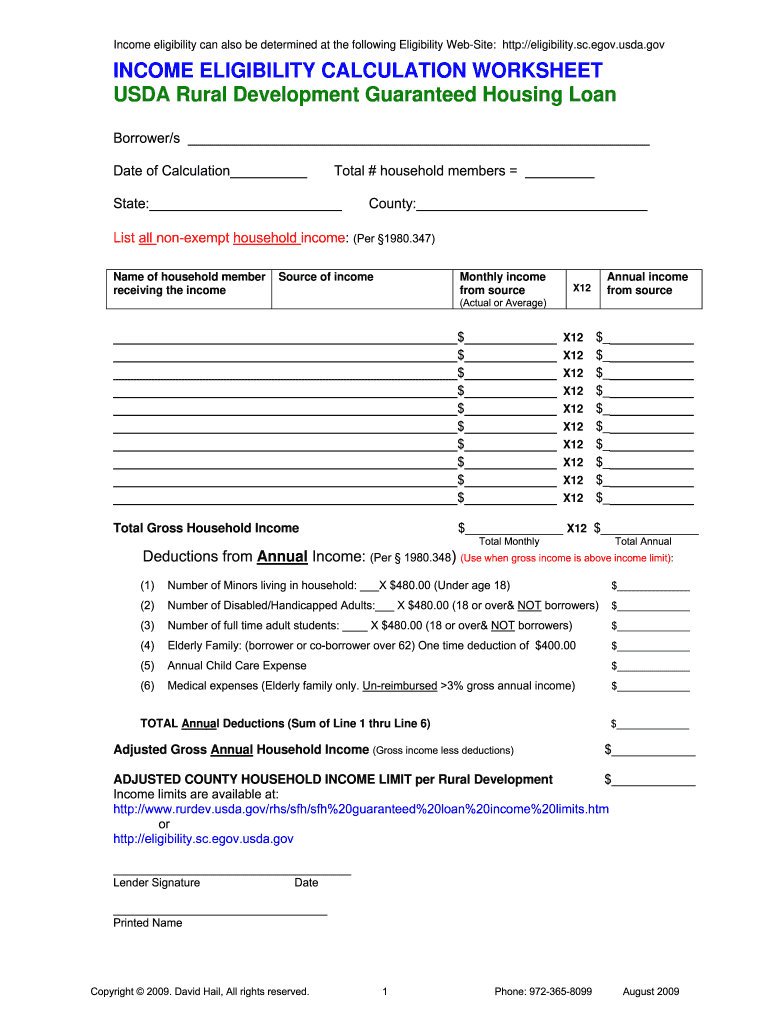

INCOME ELIGIBILITY CALCULATION WORKSHEET. USDA Rural Development Guaranteed Housing Loan. Borrower/s. Date of Calculation ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign usda income worksheet form

Edit your usda income calculator form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your usda household income worksheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing usda household income form online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit income calculation worksheet pdf form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out usda income calculation worksheet

How to fill out the USDA income calculation worksheet:

01

Gather all necessary financial documents such as tax returns, pay stubs, and statements of any other sources of income.

02

Start by filling out the household information section, including the names and social security numbers of all household members.

03

Provide accurate details about each household member's income sources, such as wages, self-employment income, Social Security benefits, and any other income sources specified on the worksheet.

04

Fill in the deductions section, including any child support payments, alimony, and monthly medical expenses.

05

Calculate the adjusted income by subtracting the deductions from the total household income.

06

Determine the annual income and compare it to the income limit for the USDA program you are applying for.

07

Complete any additional sections required by the specific USDA program, such as the self-employment section or the farm labor housing section.

Who needs the USDA income calculation worksheet?

01

Individuals or households applying for USDA programs that require income verification.

02

Individuals or households seeking assistance with housing, rural development, farm loans, or nutrition programs.

03

Applicants who want to determine their eligibility for USDA programs based on their income level and household size.

Fill

form

: Try Risk Free

People Also Ask about

How is income calculated for USDA mortgage?

Annual income is calculated for the ensuing 12 months, based on income verifications, documentation, and household composition. Lenders must examine all evidence to ensure the calculation is supported.

Does USDA go by gross or net income?

The USDA income limit goes off gross income, which is the amount prior to any payroll deductions. This income includes salary, overtime, commission, tips, bonuses and any compensation for services. Income may also include housing allowances and cost of living allowances.

How many years of tax transcripts for USDA?

Lenders must continue to obtain the most recent two years of returns as applicable. USDA requires all applicants to be current on their income tax filings. An applicant with an approved IRS extension for the current tax year may continue to be eligible if they are not delinquent on taxes owed as determined by the IRS.

Does USDA require 2 years tax returns?

Lenders must analyze the previous two years of capital gains income. An average of the previous two years may be logica l, or if the current year was 20 percent less than the previous year, the lesser must be utilized. Required Documentation: Federal income tax returns or IRS transcripts with all schedules.

How do you calculate income for mortgage underwriting worksheet?

Hourly And Salaried Monthly Income Take the amount of the hourly rate and multiply it by 40 hours. Then multiply that figure by 52 weeks. Then divide it by 12 months to get the monthly gross income. Do not count overtime income or bonuses.

Does USDA require 3 years tax returns?

The most recent tax return refers to the last return filed as determined by IRS schedule/deadlines. Lenders must continue to obtain the most recent two years of returns, as applicable. USDA requires all applicants to be current on their income tax filings.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit usda income calculation worksheet straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit usda income calculation worksheet.

How can I fill out usda income calculation worksheet on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your usda income calculation worksheet, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I fill out usda income calculation worksheet on an Android device?

Complete usda income calculation worksheet and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is usda income calculation worksheet?

The USDA income calculation worksheet is a form used to determine the eligibility of applicants for USDA rural development housing programs by calculating their household income.

Who is required to file usda income calculation worksheet?

Individuals or families applying for USDA rural housing loans or assistance programs are required to file the USDA income calculation worksheet to assess their income eligibility.

How to fill out usda income calculation worksheet?

To fill out the USDA income calculation worksheet, applicants need to gather their income information, including wages, benefits, and other sources of income, then follow the instructions on the form to report their household's total income accurately.

What is the purpose of usda income calculation worksheet?

The purpose of the USDA income calculation worksheet is to provide a standardized method for evaluating applicants' income to ensure they meet the eligibility requirements for USDA housing assistance programs.

What information must be reported on usda income calculation worksheet?

The USDA income calculation worksheet requires reporting of various types of income including wages, salary, bonuses, social security benefits, unemployment compensation, self-employment income, and any other sources of household income.

Fill out your usda income calculation worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Usda Income Calculation Worksheet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.